How Does Gambling Differ from Insurance? The Simple Explanation. Gambling intentionally puts up a stake that the gambler is willing to lose. Insurance collects payments against replacing, repairing, or recovering property that an owner is unwilling to lose. Gambling is the intentional and willful exposure of one’s self or assets to the risk.

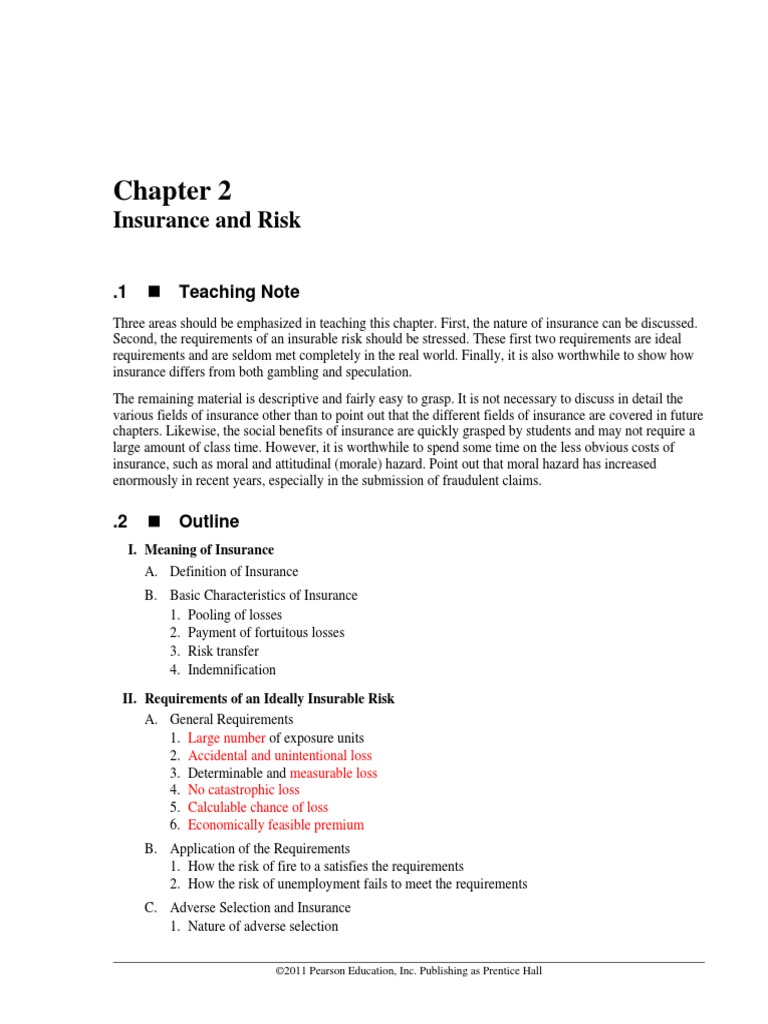

- Apr 23, 2012 Figure 3 — Differences between gambling and insurance. Insurance is not gambling. Ironically, not getting insurance is gambling with the financial futures of ourselves and our loved ones.

- Laws should not penalize individuals for gambling, whether in private groups or via casinos, bookmakers, etc. Penalties should be reserved for those who operate commercial gambling facilities. Charitable organizations, churches, etc., should be free, as they are now, to organize games of chance to raise funds.

I come across this question once in a while. People say, “If insurance is about managing risk, then isn’t that like gambling, which is about taking risks?”

This is a natural question that comes easily to mind from the confusion people have about risk. What is risk? It’s the chance that something will go wrong. You take a risk when you do something that may lead to danger or loss.

Insurance differs from gambling in two ways. First, with insurance people are pooling their resources to replace their losses from unexpected events. In gambling you are not trying to absorb or replace losses, you’re trying to increase your wealth.

Second, with insurance you only expect a certain amount of loss to occur among a group of people. These losses vary from year to year but as the decades mount up, and as people learn about causes for their losses, the losses even out and may even decline.

With gambling there is no way to stop or reduce your losses except to stop gambling. You are not sharing your losses with other people in a “risk pool”. You are simply putting your wealth out there and allowing random chance to decide if anything comes back to you.

But What About Betting Pools?

Betting pools, such as where 10-20 people share the expense of buying lottery tickets, are popular around the world. If you are putting your wealth together with other people’s wealth, isn’t that something like insurance?

In truth, it’s not. With insurance the goal is never to make a profit from the pooled resources. All people are doing is setting back a small portion of their accumulated wealth to help each other get past hard times when unexpected — or maybe we should say unlikely losses occur.

Insurance providers won’t cover high-risk activities. If throwing yourself off a 100-foot cliff guarantees you will die or be horribly injured, then no one else is going to pool their resources with you to replace your losses. They know they will ALWAYS be called upon to replace your losses.

Gamblers hope for that 1-in-100 or 1-in-1-million odd outcome, and they expect profits from putting their wealth at risk. Just because a few people expose their wealth to loss together does not mean they are managing risk.

In an insurance pool you know in advance that, barring an unusually rare event, only a small percentage of people will incur a loss in any given year. Hence, if you expect about 10% of people to lose some of their wealth, then the people who replace that loss only have to contribute about 10% (or 9%, assuming everyone has to bear some loss anyway) of their own wealth.

In a gambling pool you don’t know in advance if the wagers will pay off. But if one person loses, everyone loses. It’s an all-or-nothing proposition, not a percentage loss.

Organized Gambling is Designed to Siphon off Money

Unlike making a “street bet” on the outcome of a sporting event or unchoreographed performance, when you go to a casino or play a slot machine in a store, you are playing in a system that is designed to take some of the wealth out of the game. There is never a 100% payback in commercial gambling.

That is why oddsmaking is so important, especially in sporting event gambling. The oddsmaker’s job is not to help you maximize your winnings. His job is to make sure that whoever runs the betting always keeps some of the money. He will literally stack the odds in favor of the house, just enough to ensure that the house makes money.

Insurance Is Not Gambling Explain

In “honest” gambling there will always be some winners; state and national laws that govern commercial gambling may set statistical goals for payout percentages. In government-run lotteries, for example, where the goal is to raise money outside of normal tax systems, the lottery laws may require that as much as 60% of the money paid in is paid back out. But that means the government keeps about 40% of the money people spend on lottery tickets.

Gambling is a steady source of income for whomever controls the gambling, not for the players.

Random Chance Is Not the Same as Probability

We often speak of random chance and probability, as if they mean the same thing. In fact, “random chance” means you cannot predict when something happens. Many forms of gambling depend on random chance, or mixing up things enough that they appear to be random.

Even in a game of cards like poker or blackjack, where you expect the players to have some skill they can apply to influencing the outcome of the game, random chance cannot be totally eliminated.

However, when people share resources to replace normal, average, everyday losses they know from experience that random chance will produce losses only a certain percentage of the time. This expected percentage is the probability that something will happen. It’s not the same as saying, “Your chances of being struck by lightning are about 1 in 700,000 in the United States”. Rather, it’s saying that “about 600 people will be struck by lightning in the US this year” and in order to insure those losses we need pool wealth from as many people as possible to keep the cost of replacement low.

In other words, how many people share the risk of replacing insurable losses has no real effect on how many people may be struck by the random events that cause those losses. But in gambling, the more people who gamble the more people who lose. You can never produce more winners than losers in gambling.

Minimizing Loss is Not the Same as Sharing Loss

In gambling the chances of loss increase as gambling increases. With insurance, the chances of loss are based on activity, not on the amount of people participating in the insurance plan. So with gambling your losses correspond to how much money you bet and the number of losers correlate to how many people gamble.

With insurance losses correspond to the value of goods and services that are lost, not to how much money the people who lose those goods and services possess. You can decrease the cost of replacing lost goods and services by recruiting more people to share the expense. This is how insurance companies compete with each other.

But if insurable loss is based on the risk associated with specific behavior then losses can and do mount if people don’t take appropriate precautions to protect against expected loss. Hence, if 100,000 people drive safely you can expect a low number of automobile accidents each year; but if all those people drive erratically the number of accidents increases.

By the same token, when more people engage in activity that is known to incur a certain percentage of expected losses the total value of lost wealth increases. 50,000 people will have to replace less wealth than 100,000 in terms of insurable activities. But the loss rates remain predictable with insurable activities.

Think of it this way: losses increase faster with uncontrolled growth in gambling than with uncontrolled growth in insurable activities like driving. That is because you cannot predict how much any group of people will lose with gambling, other than to say that commercial gambling siphons off a large percentage of their money.

You cannot insure the “house cut” in any commercial gambling industry. There is no reimbursement for money that goes to the house either as a playing fee or as their share of the profits. These “losses” are expected and all but guaranteed.

Put Another Way, One Takes Money Away, Another Puts It Back

In gambling when you lose no one reimburses you for your loss. That money is gone for good.

With insurance you can expect to recoup at least some of what you lost.

So it’s maybe better to say that gambling takes money away from gamblers who decide to risk losing their wealth; but insurance reallocates reserve wealth to those people who have suffered predictable but otherwise unexpected losses beyond their control.